- DailyCoin Newsletter

- Posts

- 2023-05-11

2023-05-11

🐸 Elon, Treasure, and Angry Frogs

Good Morning, DailyCoiners,It’s crypto joke day!Batman invited all the superheroes to an evening discussing Bitcoin investments.

Superman didn’t go because it was crypto-night! 🤣🤣

Proper Dad joke right there!

Moving on…

👑 Musk's Midas Touch: Miladys NFTs Take Flight on a Single Tweet

🏴☠️ Tether's Treasure Trove: Stablecoin's Reserves Inflate to Record Heights

🐸 Ribbit Riot: Coinbase's Email Ruffles the Pepe Pond

👑 Musk's Midas Touch: Miladys NFTs Take Flight on a Single Tweet

Like a modern-day King Midas, anything Elon Musk touches, or in this case, tweets about, turns to gold.

His latest subject?

The NFT collection Miladys, which, after a Musk tweet, rose like a rocket (no SpaceX pun intended) on OpenSea, outshining even the Bored Apes.

Musk, the social media sorcerer, tweeted a meme featuring a Miladys NFT avatar with the caption, "There is no Meme, I Love You." And just like that, the "Musk Effect" worked its magic, sending Miladys floor prices sky-high. 🚀

The tweet proved to be the crypto equivalent of a love potion for the NFT community, with the collection's floor price reaching a head-spinning all-time high of 7.3 ETH ($13,475). 🤪

Musk's tweet not only gave Miladys a popularity boost but also had holders doing a victory dance, proving once again that in the world of crypto, Elon Musk's tweets are like winning lottery tickets.

🏴☠️ Tether's Treasure Trove: Stablecoin's Reserves Inflate to Record Heights

Ever heard the phrase 'cash is king'? Well, in Tether's kingdom, the adage reigns supreme.

Their recent quarterly report made pirates' treasure chests look underwhelming, boasting an all-time high of $2.44 billion in excess reserves - a staggering $1.48 billion leap in the first quarter of 2023 alone.

But where's this booty stashed?

Mainly in U.S. Treasury Bills - the financial equivalent of a fortress. 🏰

Tether's got its hand on the market's pulse, seeking to reduce its dependence on pure bank deposits like an astute sailor trimming sails amidst stormy seas.

Instead, it's eyeing the Repo market, the financial world's safe harbor, to maintain liquidity and protect its users.

The report paints Tether's reserves as more liquid than a water park on a hot summer's day, with investments held predominantly in cash, cash equivalents, and 'other short-term deposits. 💰

Their exposure to secured loans has slimmed down, while gold and Bitcoin comprise a modest part of their reserve repertoire.

As per the report, all new token issuances have been invested in the financial security blankets known as U.S. Treasury bills, or placed in overnight Repo, demonstrating Tether's keen eye on stability over stormy seas.

🐸 Ribbit Riot: Coinbase's Email Ruffles the Pepe Pond

In a twist that wouldn't look out of place in a soap opera, Coinbase's recent email newsletter has left the Pepe community hopping mad.

The email, sent out on May 10, labeled the Pepe meme as a "hate symbol" - a categorization that had the PEPE meme coin community croaking in protest.

(My puns are on fire today!) 🔥

Pepe fans leaped into action, demanding an apology from Coinbase and encouraging fellow members to delete their accounts with the crypto exchange.

One user even declared Pepe as a symbol of love, not hate, and announced his plans to move his funds to the rival crypto exchange Gemini, signing off with the battle cry hashtag:"#deletecoinbase."

The hashtag "#deletecoinbase" hopped to the trending Twitter bar as if in a chorus of discontent.

Despite the ruckus, Coinbase has remained as silent as a frog on a lily pad, offering no indication of whether it intends to list the Pepe token on its exchange. 🐸

A spokesperson simply said they had "nothing further to add." Looks like Coinbase might need to do some pond-ering on this issue.

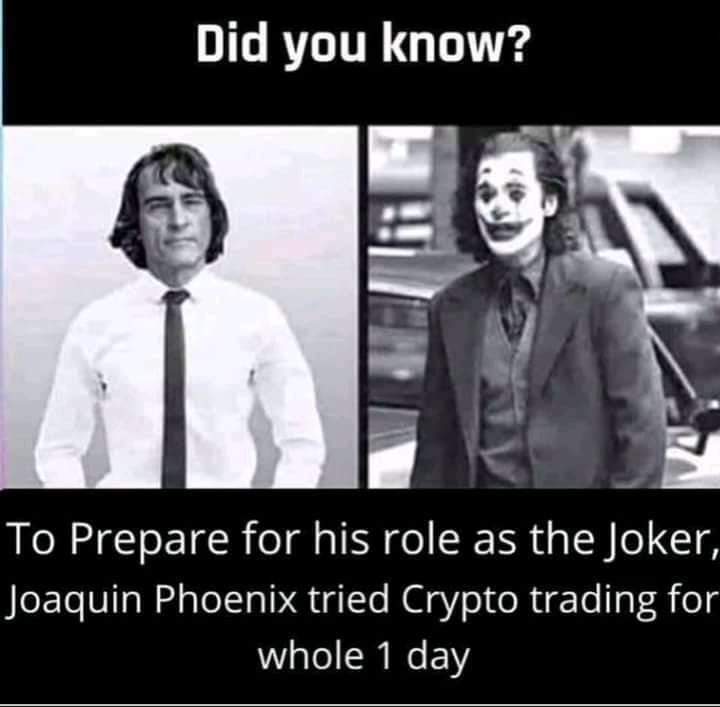

DailyCoin Daily Meme

Garlinghouse Clashes with Venture Capitalist on XRP’s Security Status

The legal status of digital currencies has been a contentious issue, with regulators and industry experts struggling to define their classification...

How Is Circle Reducing Its Exposure to U.S. Debt Default Risk?

In an effort to mitigate the risks of potential United States debt defaults, stablecoin issuer Circle has reportedly modified its...

Why Binance Is Betting on UK Base as U.S. Drives Crypto Away

Many crypto household names have found themselves in the sites of the SEC and other U.S. regulators, including Binance. However...

Thanks for joining us!

If you're hungry for more, there's always

.

See you tomorrow for more crypto fun!