- DailyCoin Newsletter

- Posts

- 2023-03-13 (3-star subs)

2023-03-13 (3-star subs)

⛏️ Falling Banks and That's "Mine" Thanks

Good morning friends,

Well, that was an interesting weekend, and today looks equally exciting.

But, as the Bangles sang, it’s just another manic Monday!

Let’s hop to it:

USDC Bounces Back

Ripple’s Exposure to SVB

Solo Bitcoin Miner Strikes Gold

USDC Bounces Back

After the second largest stablecoin, USDC, lost its $1 peg over the weekend (dropping as low as $0.87), it has been climbing back up and is now at (at the time of writing) $0.99.

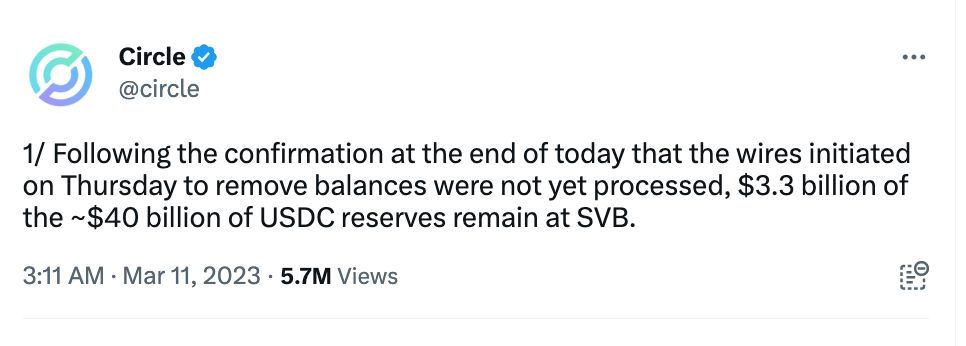

Why did it drop?When Silicon Valley Bank (SVB) was shut down by California’s Department of Financial Protection and Innovation on March 10, there were concerns about how much of Circle’s (operators of USDC) $40 Billion cash reserves were held and therefore in jeopardy at SVB.Circle announced that $3.3 billion was held at SVB.

Why did it bounce back up?Yesterday (Sunday 12th March), Circle CEO Jeremy Allaire said they had new banking partners in place, and that transfers of the $3.3 billion out of SVB they initiated before the bank’s collapse will complete today.“100% of USDC reserves are also safe and secure, and we will complete our transfer for remaining SVB cash to BNY Mellon. As previously shared, liquidity operations for USDC will resume at banking open tomorrow morning.”This, along with the U.S. government announcing a $25 billion funding program to help “liquidity-troubled banks,” seems to have reassured the markets.Just another rollercoaster ride in the crypto theme park!!

Ripple’s Exposure to SVB…Not an Issue.

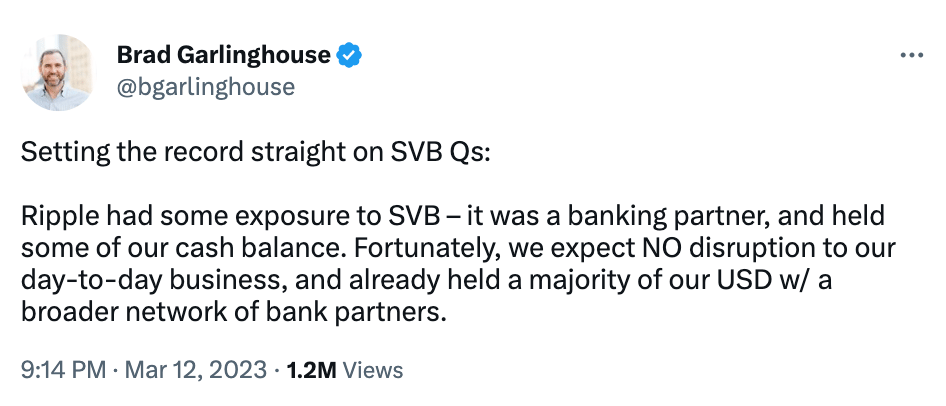

Brad Garlinghouse, Ripple Labs’ CEO, confirmed via Twitter that while they had “some exposure” to the SVB meltdown, they are still in a “strong financial position.”

Not sure anyone asked, but thanks Brad.I suppose when you’ve been the SEC’s prime target for as long as Ripple has, you have to kinda come out fighting, right?

It does make me wonder, though:

3 crypto-friendly banks (Silvergate, SVB, and Signature) all going belly up in quick succession, and the FED announces their “liquidity troubled banks” support package.

Is there something more sinister going on?

Solo Bitcoin Miner Strikes Gold

Now for some happy news.

Once the domain of nerds with a laptop, Bitcoin mining has become way more difficult, requiring vast banks of computers.

Ok, so this is a quick mining 101.“Mining” Bitcoin involves solving an incredibly complex computational math problem before anyone else. Solve the problem, and you receive the next block of bitcoins.Simple right?Well…no.It all comes down to the size of one's “computer.” The dude with the biggest one…usually wins.So, a solo miner (the little guy) very, VERY rarely successfully mines a block.

Think of it like this:

Huge mining companies are the equivalent of a Formula 1 racing car, and a solo miner is like a rusty 1970s roller skate with a missing wheel.The roller skate is quite unlikely to win the race.However, on Friday, a solo miner managed this gargantuan feat and successfully mined Bitcoin block 780,112. Netting the little guy 6.25 Bitcoin, worth a cool $150k at today’s prices (at the all-time high, this would have been worth $433k+)Nice!Oh, and the miner had only been mining for two days!Double Nice!

DailyCoin Daily Meme

Binance to Dump $1B BUSD for BTC, ETH, BNB… Here’s Why

Binance will convert about $1 billion of its Industry Recovery Initiative funds from Binance USD (BUSD) to other cryptos, including BTC...

“Crypto Has Been De-Banked:” Impact of Signature, Silvergate, and Silicon Valley Bank Collapse

Bitcoin was famously created in the wake of the 2008 banking collapse as a way for individuals to avoid the impact of centralized financial system...

Aptos (APT) Gains 13% Despite Price Manipulation Allegations

According to multiple crypto traders on Twitter, the max supply of 1,024,157,148 Aptos (APT) tokens is owned exclusively by the blockchain...

Thanks for coming for a spin with me.

If you're hungry for more, there's always

.

See you tomorrow.